Indian bond yields remain stable amid global market volatility

ANI

06 Jun 2025, 13:40 GMT+10

New Delhi [India] June 6 (ANI): As global bond markets experience turbulence amid rising long-dated treasury yields in the United States and Japan, experts say India's long-term government securities (G-secs) are expected to remain resilient, supported by strong domestic fundamentals and accommodative policy by the Reserve Bank of India (RBI).

On June 6, 2025, the Reserve Bank of India (RBI) cut the repo rate by 50 basis points.

According to the Federal Reserve Bank of St. Louis, the 30-year U.S. Treasury yield touched 4.89 per cent as of June 4, 2025, reflecting investor unease over inflation and fiscal concerns.

Simultaneously, Japan's 30-year government bond yield surged to a historically elevated level of 2.89 per cent on June 6, 2025, signalling weakening demand for long-dated sovereign debt.

Treasury bonds are critical instruments used by sovereign nations to raise funds and are purchased by a broad spectrum of investors, including retail buyers, pension funds, commercial banks, corporations, and foreign governments.

Amid this global volatility, Indian government bonds have shown relative stability. Speaking exclusively to ANI, Sonal Bandhan, Economics Specialist at Bank of Baroda, said:

'Historically, we have seen that Indian 10y G-sec movement is broadly in line with the movement in US treasury yields. However, of late, we have also seen that Indian G-sec yield has inched down, despite the volatility in the global markets. RBI's liquidity measures, lesser supply of government paper, buybacks, and low inflation have all supported this trajectory.'

Sonal added: 'Going forward as well, while there will be upside pressure on yields due to elevated US treasury yields, this will be more on the shorter end of the curve. However, the longer end of the bond curve will see downward bias driven by domestic fundamentals. Rate cuts by the RBI will also encourage low interest rate environment.'

Abhishek Bisen, Head of Fixed Income at Kotak Mahindra AMC, echoed this sentiment, noting that external bond market swings are unlikely to materially impact Indian yields.

'This scenario is unlikely to impact the Indian bond market in any material way, as there were no material flows that came from rate arbitrage purposes. The 10-year yields have been trading around 6.20 - 6.25 per cent. The Indian market is resilient and has reacted mostly to domestic factors. India headline CPI well anchored below 4.00 per cent.'

In conclusion, while global yields rise in response to fiscal stress and inflationary concerns abroad, India's sovereign bond market appears anchored by low inflation and strong domestic fundamentals.

Analysts suggest that the Indian long-end bond yields are likely to stay stable in the near to medium term. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Greek Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Greek Herald.

More InformationInternational Business

SectionU.S.-China tensions flare again as Trump threatens tougher stance

WASHINGTON, D.C.: Tensions reignite in the U.S.-China trade truce after President Donald Trump accused Beijing of violating a recent...

Indian bond yields remain stable amid global market volatility

New Delhi [India] June 6 (ANI): As global bond markets experience turbulence amid rising long-dated treasury yields in the United States...

India's forex reserves sufficient to meet 11 months of imports, 96% of external debt outstanding: RBI Governor

Mumbai (Maharashtra) [India], June 6 (ANI): India's foreign exchange reserves (Forex) are sufficient to meet 11 months of the country's...

Economic Watch: European Central Bank nearing end of rate cut cycle

Commenting on the rate cut on Thursday, the ECB President Christine Lagarde said the rates have been cut to levels which put the central...

RBI cuts repo rate by 50 bps to 5.5% under liquidity adjustment facility

Mumbai (Maharashtra) [India], June 6 (ANI): Announcing the monetary policy on Friday from Mumbai, Reserve Bank of India (RBI) Governor...

RBI Governor Sanjay Malhotra to announce policy rates today amid falling inflation

Mumbai (Maharashtra) [India], June 6 (ANI): The Reserve Bank of India (RBI) Governor Sanjay Malhotra is set to announce the policy...

Mediterranean

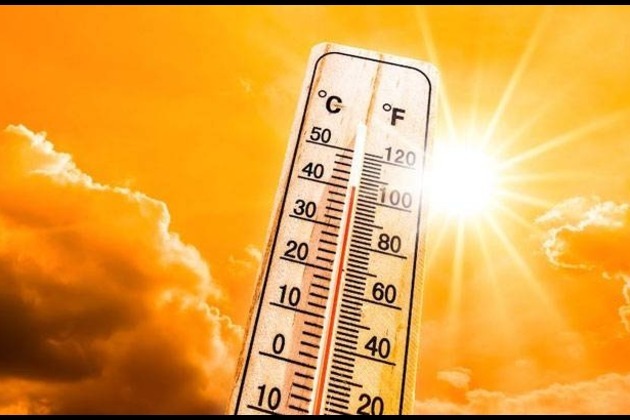

SectionStudy: Half the world faced added heat wave month due to warming

SAN JUAN, Puerto Rico: More than 4 billion people worldwide endured at least one extra month of extreme heat between May 2024 and May...

Tourists shift from U.S. to Europe as spending surges

MADRID, Spain: Europe's tourism sector is poised for a strong 2025, with international visitor spending projected to grow by 11 percent...

Cross-cultural exhibitions spark curiosity, draw crowds

BEIJING, June 6 (Xinhua) -- In a dimly lit gallery in south China's Guangxi Zhuang Autonomous Region, Zhou Jie stood before a life-sized...

Letter from Mideast: Chinese solar companies help power northern African countries towards sustainable goals

In recent years, Chinese companies have actively contributed to the green transformation. They have participated in renewable energy...

India and Italy agree to strengthen ties in Industry 4.0, Technology, Automobiles and more

Brescia [Italy], June 6 (ANI): Union Commerce and Industry Minister Piyush Goyal on Thursday said that India and Italy have agreed...

After record number of road fatalities, Israel to hold national emergency conference

Tel Aviv [Israel], June 6 (ANI/TPS): The year 2024 ended with a record of 439 fatalities in road accidents - the highest number in...