Finance Ministry asked RBI to keep small borrowers up to Rs 2 lakh out of proposed Gold loan regulations

ANI

30 May 2025, 10:34 GMT+10

New Delhi [India], May 30 (ANI): The Ministry of Finance on Friday said it has asked the Reserve Bank of India (RBI) to ensure that the needs of small gold loan borrowers are not affected by the central bank's proposed new rules on lending against gold as collateral.

The ministry, in a post on social media platform X, said that the Draft Directions on Lending Against Gold Collateral issued by the RBI have been reviewed by the Department of Financial Services (DFS) under the guidance of Union Finance Minister Nirmala Sitharaman.

The DFS has shared its suggestions with the RBI and asked the central bank to make sure that the new rules do not make it difficult for small borrowers to get gold loans. These borrowers often depend on small-ticket loans to meet urgent personal or business needs.

The post said '@DFS India has given suggestions to the @RBI to ensure that the requirements of the small gold loan borrowers are not adversely affected'.

The finance ministry also said that these new guidelines may require time to be implemented properly at the ground level. Therefore, the DFS has suggested that the RBI implement the new directions from January 1, 2026.

To further protect small borrowers, the ministry has proposed that those taking loans below Rs 2 lakh should be kept out of the new requirements. This, it said, would help ensure faster and smoother disbursal of small gold loans.

The RBI is currently getting feedbacks from stakeholders on the draft guidelines. The Finance Ministry said that it expects the RBI to carefully consider the concerns raised by various stakeholders and suggestions from the public before finalising the rules.

The Reserve Bank of India released draft guidelines to harmonise regulations for loans against gold as collateral. These rules apply to banks, cooperative banks, and NBFCs.

RBI said loans against primary gold or bullion remain prohibited. The draft mandates standardised procedures for assaying gold, setting a maximum Loan-to-Value (LTV) ratio of 75 per cent for consumption loans, and capping bullet repayment loans to 12 months.

It restricts re-pledging and mandates clear documentation, borrower consent for surprise audits, and compensation for delays or collateral loss.

RBI aims to ensure transparency, reduce risks, and protect borrowers, especially through stricter auction norms and mandatory borrower communication. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Greek Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Greek Herald.

More InformationInternational Business

SectionFrench farmers jam Paris roads in push for eased regulations

PARIS, France: French farmers brought traffic to a crawl around Paris and gathered outside the National Assembly on May 26, using their...

Finance Ministry asked RBI to keep small borrowers up to Rs 2 lakh out of proposed Gold loan regulations

New Delhi [India], May 30 (ANI): The Ministry of Finance on Friday said it has asked the Reserve Bank of India (RBI) to ensure that...

California's ports face economic devastation as tariffs cripple trade with Asia-Pacific

The uncertainty caused by tariff policies has resulted in substantial economic damage for businesses. SACRAMENTO, the United States,...

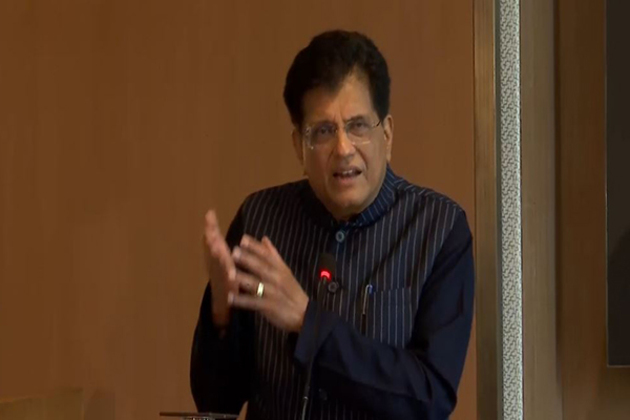

Op Sindoor became symbol of Aatmanirbhar Bharat: Piyush Goyal

New Delhi [India], May 29 (ANI): Union Commerce and Industry Minister Piyush Goyal on Thursday asserted that Operation Sindoor brought...

AI CEO issues stark warning

Up to 50% of entry-level white-collar jobs may be lost in the next five years, according to Anthropics Dario Amodei Artificial intelligence...

Ex central bank chief predicts Russia will never abandon cash

Certain groups will always choose paper over digital money in order to avoid taxation, according to Sergey Dubinin Russia is unlikely...

Mediterranean

SectionNishikant Dubey questions UPA over talks with Pakistan after 26/11, alleges US pressure influenced decision

New Delhi [India], May 30 (ANI): Bharatiya Janata Party (BJP) MP Nishikant Dubey on Friday slammed the former Manmohan Singh-led government,...

Nishikant Dubey questions Manmohan Singh over talks with Pakistan after 26/11, alleges US pressure influenced UPA-Govt's stand

New Delhi [India], May 30 (ANI): Bharatiya Janata Party (BJP) MP Nishikant Dubey on Friday slammed former Prime Minister Manmohan Singh,...

What Could New US Sanctions Against Russia Look Like

WASHINGTON -- So far, Russia has resisted Western calls for a cease-fire in its war on Ukraine. And so far, US President Donald Trump...

Daily World Briefing, May 30

Military plane crashes in S. Korea's southeastern city, killing 4 A military plane of the South Korean navy crashed on the hills...

UN-SECURITY COUNCIL-VESSELS SUSPECTED OF VIOLATING LIBYA ARMS EMBARGO-INSPECTION-AUTHORIZATION-EXTENSION

(250529) -- UNITED NATIONS, May 29, 2025 (Xinhua) -- Representatives vote on a draft resolution during a UN Security Council meeting...

"It'll be mutually beneficial," former US official on trade negotiation with India; warns Trump administration on "bullying approach"

South Carolina [US], May 30 (ANI): Former US Assistant Secretary of Commerce for Trade Development, Ray Vickery on Thursday [local...