RBI expected to transfer record dividend of Rs 2.7 to 3 lakh cr to govt in FY26: Report

ANI

17 May 2025, 15:13 GMT+10

New Delhi [India], May 17 (ANI): The RBI is expected to transfer a record surplus dividend of Rs 2.7 lakh crore to Rs 3 lakh crore to the govt in FY26, an almost 50 per cent increase YoY, highlighted a report by Front Wave Research, a SEBI-registered Research Analyst.

This would mark a sharp rise from last year's historic Rs 2.1 lakh crore transfer, and could significantly impact India's fiscal position and liquidity conditions in the coming months. The dividend is likely to be announced by late May.

The report said 'The RBI is expected to transfer a record surplus to the government in FY26, with estimates ranging from Rs 2.7 lakh crore to Rs 3 lakh crore'.

The report expected surge in surplus transfer is driven by three major factors. First, the RBI's timely forex market operations generated strong trading gains. The central bank bought US dollars at around Rs 83-84 and sold them at Rs 84-87, locking in notable profits.

Second, the RBI's over USD 600 billion in foreign exchange reserves earned higher interest income due to elevated global rates. This added significantly to the central bank's surplus.

Third, on the domestic front, the RBI earned solid income through Open Market Operations (OMOs), bond holdings, and repo transactions. These helped strengthen its balance sheet and further raised the size of the surplus available for transfer.

The report also highlighted that when these funds are paid and spent, banking system liquidity could rise sharply, potentially touching Rs 5.5-6 trillion. This would be a huge turnaround from the recent liquidity deficit.

It said 'Once the dividend is paid and spent, banking system liquidity could climb to Rs 5.5-6 trillion, up from a recent deficit'.

The bond market has already started reacting. The yield on the 10-year government bond has fallen to 6.23 per cent and may decline further as markets price in the expected liquidity surge. Short-term yields are dropping even faster, leading to a steepening of the yield curve, often seen as a sign of possible rate cuts.

Sectors like PSU banks, NBFCs, infrastructure, and consumption are already seeing positive momentum. If the record dividend is confirmed, it may act as a stealth stimulus and support economic growth through FY26. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Greek Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Greek Herald.

More InformationInternational Business

SectionRBI expected to transfer record dividend of Rs 2.7 to 3 lakh cr to govt in FY26: Report

New Delhi [India], May 17 (ANI): The RBI is expected to transfer a record surplus dividend of Rs 2.7 lakh crore to Rs 3 lakh crore...

"Modi Govt buckled under US pressure": Jairam Ramesh questions IMF bailout for Pakistan

New Delhi [India], May 17 (ANI): Congress MP Jairam Ramesh on Saturday criticised the BJP-led central government for abstaining from...

Foreign Minister Arzu Rana Deuba thanks World Bank for continued support in Nepal's development

Kathmandu [Nepal], May 17 (ANI): Nepali Foreign Minister Arzu Rana Deuba welcomed Martin Raiser, the World Bank Vice President for...

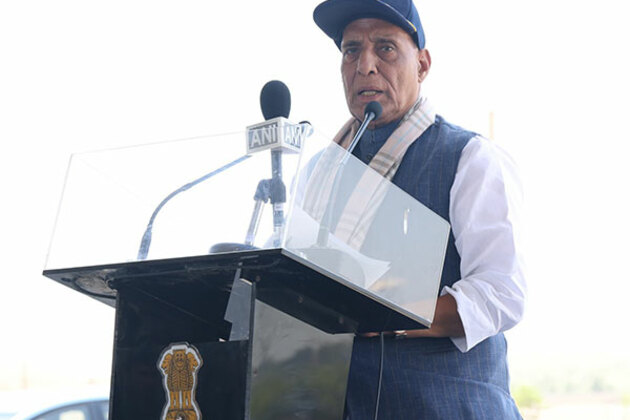

India's fight against terrorism now part of national defence doctrine: Rajnath Singh

Kutchch (Gujarat) [India], May 16 (ANI): Defence Minister Rajnath Singh on Friday said that India's fight against terrorism is not...

China construction machinery expo highlights industry's green, smart shift

CHANGSHA, May 16 (Xinhua) -- The ongoing fourth Changsha International Construction Equipment Exhibition (CICEE) has highlighted the...

H-bomb creator Richard Garwin was a giant in science, technology and policy

Richard Garwin, who died on May 13, 2025, at the age of 97, was sometimes called the most influential scientist you've never heard...

Mediterranean

SectionForeign workers drive post-pandemic growth in eurozone: ECB

FRANKFURT, Germany: Foreign workers have emerged as a critical force behind the euro zone's economic growth since the pandemic, offsetting...

(SP)CHINA-XI'AN-BASKETBALL-FIBA-XI'AN CHALLENGER 3X3-MARBELLA VS INZAI (CN)

(250517) -- XI'AN, May 17, 2025 (Xinhua) -- Fujisawa Hirotaka (L) of Inzai vies with Godwin Osarenren Moreno of Marbella during the...

BJP MP Ravi Shankar vows to convey "India's concerns" against terrorism in front of international community

Patna (Bihar) [India], May 17 (ANI): Bharatiya Janata Party (BJP) MP Ravishankar Prasad on Saturday vowed to convey India's concerns...

IDF launches Gideon Chariots campaign to release hostages

Tel Aviv [Israel], May 17 (ANI): The Israeli Defence Forces (IDF) have launched 'Gideon Chariots' campaign for the release of its remaining...

Rajasthan: Ajmer fruit traders boycott Turkish fruit over Turkey's support for Pakistan

Ajmer (Rajasthan) [India], May 17 (ANI): Amid heightened tensions between India and Pakistan, local fruit traders in Ajmer, Rajasthan,...

ISRAEL-YEMEN-HOUTHI-CONTROLLED PORTS-AIRSTRIKES

(250517) -- JERUSALEM, May 17, 2025 (Xinhua) -- This photo released by the Israel Defense Forces on May 16, 2025 shows an Israeli military...