RBI's policy stance turning accommodative shows signs of easing: SBI Report

ANI

10 Apr 2025, 09:03 GMT+10

Mumbai (Maharashtra) [India], April 10 (ANI): The Reserve Bank of India (RBI) has taken a more accommodative stance in its monetary policy, as inflation expectations have shown signs of easing.

According to a recent report by the State Bank of India (SBI), the central bank's decisions are not only influenced by past inflation trends but also take into account expectations for the future.

It said 'We explore whether shifts in RBI's monetary policy stance have followed changes in household inflation expectations. Specifically, we hypothesize that the RBI's stance responds to directional changes in inflation expectations'.

The report noted that the RBI's recent shift in policy stance--from neutral to accommodative--is backed by moderating inflation expectations. Households now expect inflation to be around 8.9 per cent for the next three months.

This indicates a downward shift in inflation sentiment, prompting the RBI to support growth by easing its monetary policy.

SBI analyzed five different instances between 2018 and 2024 when the RBI's Monetary Policy Committee (MPC) changed its stance. It found that these changes often followed clear shifts in household inflation expectations.

For instance, when inflation expectations rose, the RBI tightened its stance. Conversely, when expectations fell, the central bank eased or normalized its policy. This pattern suggests that the RBI is adapting its policy proactively, trying to manage future risks rather than reacting only to current data.

The report also highlighted that anchoring inflation expectations is essential for ensuring price stability, which aligns with standard global economic thinking.

On the interest rate front, the SBI report points out that a total of 50 basis points (bps) in policy rate cuts have been made since February 2025. Following the RBI's 25 bps repo rate cut in February, public sector banks reduced deposit rates by 6 bps and foreign banks by 15 bps.

Interestingly, private banks increased their deposit rates by 2 bps, indicating varied transmission patterns across bank groups.

Despite these differences, the weighted average lending rates (WALR) on fresh loans for public sector banks, private banks, and scheduled commercial banks have closely followed changes in the policy rate. This suggests that the overall transmission of monetary policy remains effective and timely.

The SBI report thus emphasizes that the RBI's policy is both responsive to real-time developments and forward-looking, aiming to balance inflation control with economic growth. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Greek Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Greek Herald.

More InformationInternational Business

SectionVegetable oil price surge stabilizes global food costs in March

PARIS, France: A spike in vegetable oil costs helped steady global food prices in March, offsetting declines in other staples like...

RBI's policy stance turning accommodative shows signs of easing: SBI Report

Mumbai (Maharashtra) [India], April 10 (ANI): The Reserve Bank of India (RBI) has taken a more accommodative stance in its monetary...

Global financial system entering unchartered territory Deutsche Bank

The US-China standoff risks escalating into an outright financial war with no winners, the banks head of global FX research warns ...

US tariffs have mixed fiscal impact, will not solve underlying challenges: Fitch Ratings

New Delhi [India], April 9 (ANI): Tariff revenues will help narrow the US budget deficit in 2025, but the hit to economic growth and...

Trump pushes for "one big beautiful bill", says "USA will soar like never before"

Washington, DC [US], April 9 (ANI): US President Donald Trump on Wednesday pushed for a 'one big beautiful bill' and told fellow Republicans...

Vizhinjam Port in Kerala welcomes world's largest, eco-friendly container ship MSC Turkiye

New Delhi [India], April 9 (ANI): Vizhinjam International Seaport near Thiruvananthapuram in Kerala on Wednesday welcomed the world's...

Mediterranean

SectionJoe Ryan, Twins shut out Royals

(Photo credit: Jay Biggerstaff-Imagn Images) Joe Ryan continued his mastery of Kansas City hitters by tossing two-hit ball over seven...

Egypt condemns Israeli closure orders to UNRWA schools in East Jerusalem

Cairo [Egypt] April 10 (ANI/WAM): Egypt strongly condemned on Wednesday the Israeli occupation's closure orders for six schools operated...

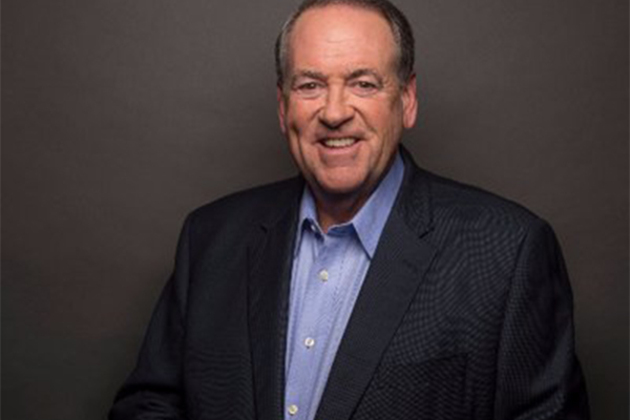

US Senate confirms former Arkansas governor Mike Huckabee as Israel ambassador

Washington DC [US], April 10 (ANI): US President Donald Trump on Wednesday (local time) signed the commission for former Arkansas Governor...

(SP)SLOVENIA-CELJE-VOLLEYBALL-EHF CHAMPIONS LEAGUE WOMEN 2025-SLOVENIA VS SERBIA

(250410) -- CELJE, April 10, 2025 (Xinhua) -- Nusa Fegic (R) of Slovenia shoots at the goal during the EHF Champions League Women 2025...

(SP)EGYPT-CAIRO-FOOTBALL-CAF CONFEDERATION CUP-QUARTERFINAL

(250410) -- CAIRO, April 10, 2025 (Xinhua) -- Nabil Emad (R) of Zamalek vies for the ball during the 2024/25 Confederation of African...

Daily World Briefing, April 10

U.S. stocks surge after Trump pauses many of his tariffsNEW YORK -- U.S. stocks skyrocketed on Wednesday after the U.S. President Donald...