The Reserve Bank has cut rates for the first time in four years. But it is cautious about future cuts

The Conversation

18 Feb 2025, 04:53 GMT+10

The Reserve Bank cut official interest rates on Tuesday, the first decrease in four years, saying inflationary pressures are easing "a little more quickly than expected".

However, the central bank said the outlook for economic activity and inflation remains uncertain, with a risk that household spending may be slower than expected.

The reduction in the cash rate target will come as a relief to the one-third of households with a mortgage. It will help to ease the cost of living crisis for them.

The cut from a 13-year high of 4.35% to 4.1% had been widely expected by economists and financial markets.

The interest rate cut may help tip the scales for the government to call an early election. But recent opinion polls suggest the government still has work to do to put itself in a winning position.

Announcing its decision, the Reserve Bank said it had "more confidence that inflation is moving sustainably towards the midpoint of the 2-3% target".

All four of the major banks swiftly passed on the cut in official rates to mortgage-holders. The average new housing loan is $666,000. Reducing the interest rate on this by 0.25% will mean $110 less a month in repayments (assuming a standard 30-year loan).

It is the first change in the cash rate since November 2023 and marks the first small reversal of 13 rate increases. The central bank had hiked interest rates quickly from the near-zero emergency level during the COVID epidemic and lockdowns.

The interest rate cut comes after headline inflation eased, to 2.4% during 2024, within the Bank's 2-3% inflation target range.

However, the Bank's preferred measure of underlying inflation, the "trimmed mean", which excludes temporary factors such as the government's electricity rebates, rose by 3.2% during 2024. This is just above the target range but a little less than the 3.4% the Bank had been forecasting.

"We cannot declare victory on inflation just yet," Reserve Bank Governor Michele Bullock told a press conference after the decision. "It's not good enough for it to be back in the target range temporarily, the board needs to be confident it's returning to the target range sustainably."

Read more: Lower inflation in the December quarter boosts chances of an interest rate cut

In its first meeting for the year, the Reserve Bank board rejected the notion that they should hold off changing rates because an election is approaching.

While cutting interest rates will suit one side of politics, not cutting would have benefited the other. The impartial approach is to take the same decision as if no election were looming.

As then RBA governor Glenn Stevens said in 2007 after raising rates during an election campaign:

I do not think we ever could accept the idea that in an election year - which, after all, is one year out of three - you cannot change interest rates.

Some central banks in comparable economies had already started lowering interest rates and have cut them by more than the RBA. But that is because most had raised interest rates by more.

The Reserve Bank adopted a strategy of being more patient in returning inflation to its target, so as to limit the increase in unemployment.

The strategy has worked. Unemployment in Australia peaked at 4.2% and is now 4.0%. By contrast, in New Zealand it is over 5% and in the euro area and Canada it is over 6%.

The Reserve Bank hasn't received the credit it deserves for this strong performance.

This is the last meeting of the current Reserve Bank board. It is being replaced by a new monetary policy committee, and a separate governance board as part of an overhaul of the bank. Two new members will replace two members of the current board for its next meeting on April 1.

The RBA board's statement said that it "remains cautious on prospects for further policy easing". This is central bank-speak for not rushing into further interest rate cuts.

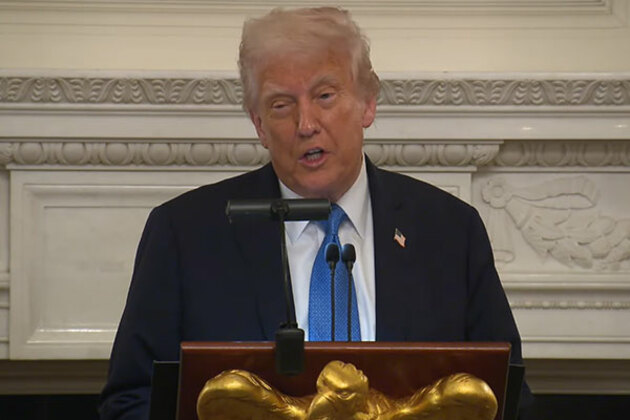

The RBA also noted that "geopolitical and policy uncertainties are pronounced". This is a reference to the economic fallout from United States President Donald Trump's policies on trade and slashing jobs.

His proposed tariffs and deportations will increase inflation in the US and make US interest rates higher than they otherwise would be.

Read more: What would a second Trump presidency mean for the global economy?

But this does not mean interest rates need to be higher here. Indeed, a trade war would weaken the global economy, which could lead to less inflation in Australia.

The Reserve Bank also released its updated forecasts. These show the underlying inflation rate dropping to 2.7% by June and then staying around there through 2026 and 2027.

Unemployment is low at 4%, and below what the Bank has previously regarded as "full employment". But it is not leading to any surge in wage growth.

Indeed, the Bank commented that wages growth has been a little lower than it had forecast. Inflationary expectations are also well contained.

This offers hope there may be at least one further interest rate cut later this year (and the Reserve Bank's forecasts assume this). But borrowers should not get their hopes up that interest rates will revisit the COVID-era lows. That is very unlikely.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Greek Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Greek Herald.

More InformationInternational Business

SectionBoeing clinches record jet deal with Qatar Airways during Trump visit

DOHA, Qatar: Boeing secured its largest widebody aircraft deal this week, as Qatar Airways placed firm orders for 160 jets with options...

"11 years, 151 foreign trips, 72 countries": Mallikarjun Kharge criticises PM Modi's foreign policy

New Delhi [India], May 20 (ANI): Congress President Mallikarjun Kharge on Tuesday criticised Prime Minister Narendra Modi's foreign...

Solar Industries India Limited posted highest ever yearly revenue, profits with orderbook of Rs 17000 crore in FY 2025

New Delhi [India], May 20 (ANI): Solar Industries India Limited (SIIL) posted the highest ever yearly revenue and profits with a significant...

Taiwan to set up sovereign wealth fund

Taipei [Taiwan], May 20 (ANI): President Lai Ching-te on Tuesday announced a plan during his first anniversary speech for Taiwan to...

CBUAEimposes financial sanction ofAED200 million on exchange house

ABU DHABI, 20th May, 2025 (WAM) -- The Central Bank of the UAE (CBUAE) imposed a financial sanction of amount AED200 million on an...

"Progress being made" in Russia-Ukraine conflict, Trump says after call with "nice gentleman" Putin

Washington, DC [US], May 20 (ANI): US President Donald Trump has claimed that he was doing the best he could with his Russian counterpart,...

Mediterranean

SectionForeign Secy Misri briefs all-party delegations visiting partner countries to highlight India's fight against terrorism

New Delhi [India], May 20 (ANI): Foreign Secretary Vikram Misri on Tuesday briefed Members of Parliament and delegation members at...

Nicole Kidman says she wakes up at 3 am to this surprising thing

Cannes [France], May 20 (ANI): Nicole Kidman recently shared a personal part of her creative process while speaking at the 2025 Cannes...

Himachal Pradesh: Kotkhai delegation demands complete ban on Turkish apples

Shimla (Himachal Pradesh) [India], May 20 (ANI): A delegation of Tharonk village of Kotkhai area of Shimla district called on Himachal...

EU adopts 17th sanctions package, UK imposes 100 new sanctions against Russia

Brussels [Belgium], May 20 (ANI): The European Union and the United Kingdom unveiled new sanctions targeting Russia's economy, shadow...

UK suspends free trade negotiations with Israel citing Gaza concerns; Israel calls it "anti-Israel obsession"

London [UK], May 20 (ANI): UK Foreign Secretary David Lammy on Tuesday announced the suspension of free trade agreement negotiations...

Cannes veteran Aishwarya Rai Bachchan touches down France with daughter Aaradhya

Cannes [France], May 20 (ANI): Bollywood actress and former Miss World, Aishwarya Rai Bachchan is a regular at Cannes Film Festival....