UBS Mulls Credit Suisse Takeover with Swiss Government Assurances

Voice of America

19 Mar 2023, 00:36 GMT+10

UBS AG was mulling a takeover of its embattled Swiss peer Credit Suisse Saturday, sources said, which could allay fears that an unfolding crisis at the bank might destabilize the global financial system.

The 167-year-old Credit Suisse is the biggest name ensnared in the turmoil unleashed by the collapse of U.S. lenders Silicon Valley Bank and Signature Bank over the past week, spurring a broad-based loss in investor confidence globally.

Both U.S. and European banking executives and regulators have taken extraordinary measures to shore up the industry to try to restore confidence. The Biden Administration moved to backstop consumer deposits while the Swiss central bank lent billions to Credit Suisse to stabilize its shaky balance sheet.

UBS was under pressure from the Swiss authorities to carry out a takeover of its local rival to get the crisis under control, two people with knowledge of the matter said. The plan could see the Swiss government offer a guarantee against the risks involved, while Credit Suisse's Swiss business could be spun off.

UBS, Credit Suisse and Switzerland's financial regulator FINMA declined to comment.

The Financial Times said the three were rushing to finalize a merger deal as soon as Saturday evening, citing people familiar with the matter.

U.S. authorities are involved, working with their Swiss counterparts to help broker a deal, Bloomberg News reported, also citing those familiar with the matter.

Credit Suisse shares lost a quarter of their value in the last week. It was forced to tap $54 billion in central bank funding as it tries to recover from a string of scandals that have undermined the confidence of investors and clients. This made it the first major global bank to take up an emergency lifeline since the 2008 financial crisis.

The company ranks among the world's largest wealth managers and is considered one of 30 global systemically important banks whose failure would ripple throughout the entire financial system.

The banking sector's fundamentals are stronger, and the global systemic linkages are weaker than during the 2008 global financial crisis, Goldman analyst Lotfi Karoui wrote in a late Friday note to clients. That limits the risk of a 'potential vicious circle of counterparty credit losses,' Karoui said.

'However, a more forceful policy response is likely needed to bring some stability,' Karoui said. The bank said the lack of clarity on Credit Suisse's future will pressure the broader European banking sector.

A senior official at China's central bank said Saturday that high interest rates in the major developed economies could continue to cause problems for the financial system.

There were multiple reports of interest for Credit Suisse from other rivals. Bloomberg reported that Deutsche Bank was looking at the possibility of buying some of its assets, while U.S. financial giant BlackRock denied a report that it was participating in a rival bid for the bank.

Interest rate risk

The failure of California-based Silicon Valley Bank brought into focus how a relentless campaign of interest rate hikes by the U.S. Federal Reserve and other central banks - including the European Central Bank this week - was pressuring the banking sector.

SVB and Signature's collapses are the second- and third-largest bank failures in U.S. history behind the demise of Washington Mutual during the global financial crisis in 2008.

Banking stocks globally have been battered since SVB collapsed, with the S&P Banks index falling 22%, its largest two weeks of losses since the pandemic shook markets in March 2020.

Big U.S. banks threw a $30 billion lifeline to smaller lender First Republic, and U.S. banks altogether have sought a record $153 billion in emergency liquidity from the Federal Reserve in recent days.

This reflects 'funding and liquidity strains on banks, driven by weakening depositor confidence,' said ratings agency Moody's, which this week downgraded its outlook on the U.S. banking system to negative.

While support from some of the titans of U.S. banking prevented First Republic's collapse, investors were startled by disclosures on its cash position and how much emergency liquidity it needed.

In Washington, focus has turned to greater oversight to ensure that banks and their executives are held accountable.

U.S. President Joe Biden called on Congress to give regulators greater power over the sector, including imposing higher fines, clawing back funds, and barring officials from failed banks.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Greek Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Greek Herald.

More InformationInternational Business

SectionBird flu plan in the works as USDA weighs export, vaccine risks

CHICAGO, Illinois: For the first time in history, U.S. officials are considering a coordinated plan to vaccinate poultry against bird...

Farmers exploit loophole in Amazon soy deal to clear rainforest

SANTAREM, Brazil: As Brazil cements its position as the world's top soy exporter, a new wave of deforestation is spreading across the...

Europe eases rates as Fed holds and Trump threatens tariffs

ZURICH, Switzerland: A wave of central banks across Europe surprised markets last week by lowering interest rates, responding to easing...

Carney sets 30-day deadline for US trade deal

OTTAWA, Canada: Canada may boost its counter-tariffs on steel and aluminum imported from the U.S. if a comprehensive trade agreement...

Federal Reserve chief weighs next move as economic outlook wavers

WASHINGTON, D.C.: The U.S. economy is performing reasonably well, but Federal Reserve Chair Jerome Powell faces a difficult decision...

Under patronage of Mansour bin Zayed, CBUAE concludes Climate Forum in Abu Dhabi

ABU DHABI, 26th June, 2025 (WAM) -- The Central Bank of the UAE (CBUAE) concluded its Climate Forum today in Abu Dhabi, held under...

Mediterranean

SectionIndia evacuated 3,426 Indian nationals from Iran, 818 from Israel in Operation Sindhu: MEA

New Delhi [India], June 26 (ANI): The Ministry of External Affairs spokesperson Randhir Jaiswal said that India, so far have evacuated...

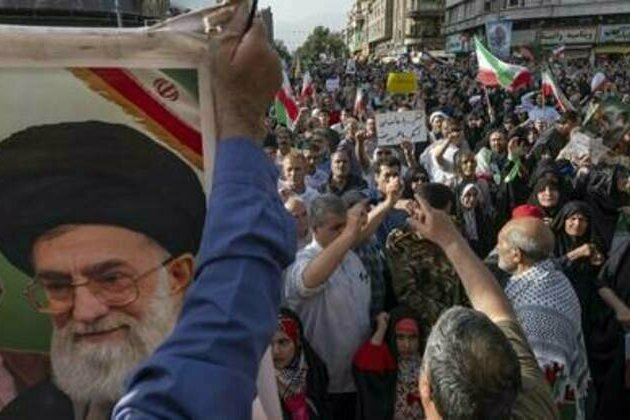

Iranian Supreme Leader says U.S. gains nothing from war with Iran

TEHRAN, June 26 (Xinhua) -- Iranian Supreme Leader Ali Khamenei said on Thursday the United States gained nothing from the war against...

Oil prices surge on new US data

Crude has gained momentum as American stockpiles drop and Middle East tensions show signs of easing ...

Iran truce could inspire Ukraine peace Trump envoy

Middle East deescalation could motivate Moscow and Kiev to pursue diplomatic solutions, Steve Witkoff has said A ceasefire between...

Iran's supreme leader declares victory over Israel and US

Ayatollah Khamenei says America joined the conflict to rescue the Zionist regime after Tehran's crushing retaliation ...

Irans supreme leader declares victory over Israel and US

Ayatollah Khamenei says America joined the conflict to rescue the Zionist regime after Tehrans crushing retaliation Iranian Supreme...